The Hollywood Reporter has taken a deep dive look into the financial risk that Bob Iger is taking with Disney in the Disney+ streaming launch.

Over the past two years, Iger has been singularly focused on reorienting The Walt Disney Company, founded in 1923 at the dawn of the motion picture industry, for its streaming future.

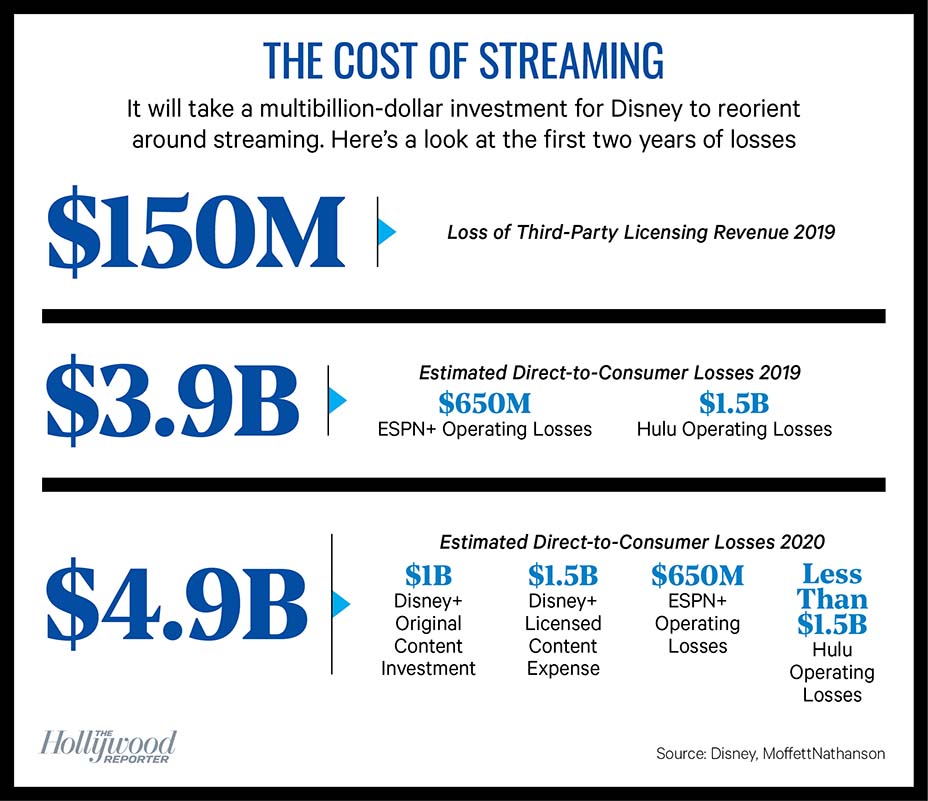

He’s invested $2.6 billion to acquire the necessary technology, shuffled his executive ranks to create a new direct-to-consumer division, forgone $150 million in annual income by ending the studio’s output deal with Netflix and even spent $71.3 billion for the 21st Century Fox assets to beef up Disney’s production capabilities and content library.

Though it’s a risky bet for a company that most recently generated $6.7 billion in quarterly revenue from its legacy television business, Iger argues that it would have been a bigger risk to sit back and do nothing as customers ditch cable for streaming options. “This is necessary,” he says. “The risk would have been essentially maintaining a status quo approach to how we were managing our content.”

“Disney is betting the whole company on streaming,” says Jeffrey Cole, director of the USC Annenberg Center for the Digital Future. “You can feel [them putting] pedal to the metal.”

Disney executives are, not surprisingly, downplaying the challenges. The company is projecting between 60 million and 90 million global subscribers by 2024, more than the 28 million U.S. members that Hulu currently has and in line with the 83 million that Netflix had within five years of separating its streaming subscription service from its DVD plans. “We like the hand we have,” says Kevin Mayer, who leads Disney+ as chairman of the company’s direct-to-consumer and international division. “We’ve collected some of the most preeminent brands in the entertainment sphere and we’re using them aggressively. We have the timing. We have the right price point.”

For the full fascinating story pick up the October 16th issue of The Hollywood Reporter magazine.